Overall Rating: 4.1 / 5

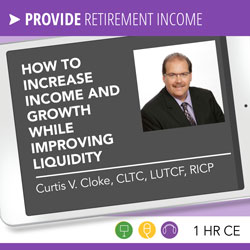

Understanding what retirees want and what keeps them up at night are major elements for financial professionals to resolve and solve for their pre-and-post retiree clients.

It is important to build portfolios that create a base of income they cannot destroy, one they cannot outlive, and when done correctly, protect principal that cannot be lost if dying to soon. Investing solutions should focus on income flow, discretionary liquidity, growth opportunities and legacy goals.

During this session, we will address many myths and biases that surround these questions and show you how building a retirement income floor that incorporates insurance guarantees can help clients meet their emotional and financial needs for a lifetime.

Gain insight into how an income floor strategy can use fewer assets for income and free up more assets for growth, liquidity, and legacy.

- Safe Income: Luck vs. Skill (Predictable vs Unpredictable);

- Liquidity: Understanding the “Illusion of Control”… FOMO (fear of missing out);

- The top five risks to mitigate in retirement;

- How to take a “basket of products approach” (agnostic approach);

- The benefits of buying income and investing the difference;

- Providing more for long-term growth and liquidity and legacy goals.

This on-demand webinar is a recording of a recent live webinar. Check our WEEKLY REBROADCAST SCHEDULE where there is no need to take the online quiz to receive CE. You may also take this on-demand course any time for 1 hr CFP®, CRC®, and other Continuing Education Credit when you pass the online quiz.

Your presenter is Curtis Cloke, CLTC, LUTCF, RICP, award-winning financial professional and retirement income expert, trainer, and speaker.

Retirement planning experience

Curtis Cloke, CLTC, LUTCF, RICP, is an award-winning financial professional and retirement income expert, trainer, and speaker with three decades of experience in income distribution planning.

Curtis began his career as a financial professional with Prudential Financial. After many successful years with Prudential, he merged with a second firm and then in may of 2014, he founded his own firm, Acuity Financial, Inc. This is where his continues to apply and blend his expertise for his clients by providing advanced retirement income-planning strategies and techniques for financial professionals. Curtis is the developer of the Thrive Income Distribution System®, that provides a contractual solution for inflation-adjusted income utilizing the least amount possible of the client’s portfolio value. He has also developed and provided continuing education training to professionals on many topics relating to retirement and estate- planning strategies.

Memberships/Certifications

Curtis is a member of the National Insurance and Financial Advisors Association (NAIFA), and is a former president of the Southeast Iowa Association. He is a member of the Society of Financial Service Professionals (FSP) and is a qualifying member of Top of the Table with the Million Dollar Round Table (MDRT). He has earned his CLTC (Certified in Long Term Care) and LUTCF (Life Underwriters Training Council) designations, and moderates development courses for the Life Underwriters Training Council.

Retirement planning thought leadership and expertise

Curtis actively engages all his audiences with his personable character and genuine care for clients’ retirement needs and concerns. Through his extensive experience, he has perfected the ability to quickly and accurately identify the income needs of all his clients and he’s developed a system-based sales approach that he teaches to advisors. Beyond using annuities to create guaranteed income for life, he shows advisors how to generate the maximum inflation-adjusted income for their clients using the least amount of the portfolio.

With a track record of spot-on media commentary, Curtis Cloke’s expertise has been featured in Senior Market Advisor, InsuranceNewsNet, Retirement Income Journal, NAFA Annuity Outlook, The Wealth Channel magazine, LifeHealthPro.com, and many more. He is a frequent guest on radio and TV stations, has appeared as a guest on NAIFA ClientCast by Real Wealth® and as a guest presenter on their webinar series, Power Session LIVE by Real Wealth®. Curtis was recognized in 2009 as a top-five finalist for Advisor of the Year by Senior Market Advisor magazine.

Invest in Your Retirement Expertise.

1 hr CFP®, CRC®, and other CE Credit Reporting

We are a CE Sponsor with the CFP Board of Standards and the professional development partner of the International Foundation for Retirement Education (InFRE).

We will report your CFP® and/or CRC® credit (no additional reporting fee). Please add your ID at checkout. You are responsible for reporting all other certification CE credit.

Over 50 courses are accepted for continuing education (CE) credit for those who have earned the Certified Financial Planner® (CFP®) certification, the International Foundation for Retirement Education’s (InFRE) Certified Retirement Counselor® (CRC®) certification, the College for Financial Planning’s Chartered Retirement Plan Consultant (CRPC) certification, the American College’s designations (ChFC, CLU, RICP), Retirement Management Analyst designation (RMA), ASPPA and other certification or designations.

Do you need more than four hours of CE?

Then become a Subscriber! Just notify us that you want to become a subscriber within 10 days of course purchase to apply the cost of your individual cost to a new subscription.

Not familiar with on-demand courses?

We help you be sure you’re comfortable navigating our on-demand system. Just contact customer service by email anytime or by phone at 847.686.0440 x105 during eastern time regular business hours.

Your satisfaction is guaranteed. We know you will be pleased with your purchase of any of our courses or subscription products. If, however, you are not completely satisfied, just notify us within 30 days of your purchase to receive a full refund of your fee.