Overall Rating: 8.4 / 10

The fastest growing age group in the U.S. are people over age 85, and more than $40 trillion of their assets will be transferred to the next generation by 2050.

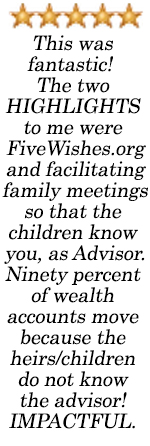

However, over 90% of children will not hire their parent’s financial advisor to manage their investments.

Alzheimer’s is the most feared health condition of later life among retirees, ranking higher than COVID-19, cancer, heart attack and stroke. Research has shown that almost 70% of those who plan to retire in the next 10 years say they have no idea what their healthcare and long-term care costs will be in retirement. Advisors must develop a financial protocol to help families deal with this risk.

This presentation will help advisors understand today’s changing demographics and dynamics to satisfy the needs of their aging clients and their families, or risk losing them to advisors who will.

In "Age Wave: Meeting the Elder Planning Needs of Today’s Retiree" by Bob Mauterstock you will learn of seven basic elder planning skills, including:

- Facilitating successful family meetings;

- Long term care planning;

- End of life planning;

- Creating a lasting legacy;

- Dealing with clients’ diminished mental capacity.

This on-demand webinar is a recording of a recent live webinar. Check our WEEKLY REBROADCAST SCHEDULE where there is no need to take the online quiz to receive CE. You may also take this on-demand course any time for 1 hr CFP®, CRC®, and other Continuing Education Credit when you pass the online quiz.

Your presenter is Bob Mauterstock, CFP®, ChFC, CLTC, Eldercare Expert, Speaker, Author, Facilitator.

Retirement planning experience

In 1987 Bob qualified as a Certified Financial Planner® and became a specialist in retirement income planning, long term care planning, investment management and legacy planning. For over 35 years, Bob has helped families achieve a worry-free, comfortable retirement. He has inspired baby boomers and their adult children to give each other the gift of communication and preserve their legacy for future generations. In 1987 he qualified as a Certified Financial Planner® and became a specialist in retirement income planning, long term care planning, investment management and legacy planning.

Retirement planning thought leadership and expertise

Bob Mauterstock, CFP®, ChFC, CLTC, is an accomplished speaker, author and sought after authority on the financial concerns of baby boomers and their adult children.

For over 35 years, Bob has helped families achieve a worry-free, comfortable retirement. He has inspired baby boomers and their adult children to give each other the gift of communication and preserve their legacy for future generations. In 1987 he qualified as a Certified Financial Planner® and became a specialist in retirement income planning, long term care planning, investment management and legacy planning.

Bob focuses on helping financial advisers to learn the skills to advise their clients on eldercare issues. Most advisers have been well trained to do retirement planning, investment management and education funding. But few have the skills to help their clients (or their parents) deal with all the issues of aging.

Invest in Your Retirement Expertise.

1 hr CFP®, CRC®, and other CE Credit Reporting

We are a CE Sponsor with the CFP Board of Standards and the professional development partner of the International Foundation for Retirement Education (InFRE).

We will report your CFP® and/or CRC® credit (no additional reporting fee). Please add your ID at checkout. You are responsible for reporting all other certification CE credit.

Over 50 courses are accepted for continuing education (CE) credit for those who have earned the Certified Financial Planner® (CFP®) certification, the International Foundation for Retirement Education’s (InFRE) Certified Retirement Counselor® (CRC®) certification, the College for Financial Planning’s Chartered Retirement Plan Consultant (CRPC) certification, the American College’s designations (ChFC, CLU, RICP), Retirement Management Analyst designation (RMA), ASPPA and other certification or designations.

Do you need more than four hours of CE?

Then become a Subscriber! Just notify us that you want to become a subscriber within 10 days of course purchase to apply the cost of your individual cost to a new subscription.

Not familiar with on-demand courses?

We help you be sure you’re comfortable navigating our on-demand system. Just contact customer service by email anytime or by phone at 847.686.0440 x105 during eastern time regular business hours.

Your satisfaction is guaranteed. We know you will be pleased with your purchase of any of our courses or subscription products. If, however, you are not completely satisfied, just notify us within 30 days of your purchase to receive a full refund of your fee.