The Internal Revenue Code (Code) and the Employee Retirement Income Security Act of 1974 (ERISA) do not prohibit the use of cryptocurrency as an investment option in a 401(k) plan.

Fidelity Investments will offer participants the option to put bitcoin in their 401(k)s by the middle of 2022.

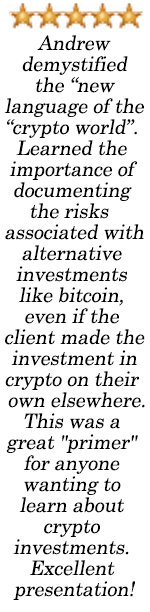

However, the Department of Labor cautions plan fiduciaries to exercise extreme care before they consider adding a cryptocurrency option to a 401(k) plan’s investment menu for plan participants. As retirement financial planners and fiduciaries, we need to understand how to work with and appropriately advise clients about the risks and potential benefits of cryptocurrency investments in their retirement plans.

In "Cryptocurrency Investments – What Financial Advisors and Planners Need Know to Avoid Legal Actions" by Andrew Shedlock, you will learn real-world examples and counsel for:

- Planners and fiduciaries to understand the basis of what cryptocurrency investments are and how they work;

- Understanding the main areas of risk and liability that planners face using cryptocurrency investments, and how to discuss the intricacies and details of various types of cryptocurrencies with clients;

- How planners can avoid and lessen risks and potential liability when dealing regulators when it comes to cryptocurrency investments.

This on-demand webinar is a recording of a recent live webinar. Check our WEEKLY REBROADCAST SCHEDULE where there is no need to take the online quiz to receive CE. You may also take this on-demand course any time for 1 hr CFP®, CRC®, and other Continuing Education Credit when you pass the online quiz.

Your presenter is Andrew Shedlock, Partner, Kutak Rock.

Retirement planning experience

Andrew Shedlock is a partner with the Kutak Rock law practice in Minneapolis. He is a litigator and attorney for financial advisors, financial planners, RIAs, and broker-dealers. Andrew advises on Non-Fungible Tokens (“NFTs”), cryptocurrency and Bitcoin, including securities and contract matters in those areas. Using his securities and regulatory background, he and his firm assist participants in the crypto, defi, blockchain and defi space to comply with laws and regulations, be proactive and drive development and investments in this developing space.

Retirement planning thought leadership and expertise

Andrew also provides legal and regulatory advice to businesses and individuals in the securities industry, including broker / dealer compliance, investment due diligence, regulatory compliance, SEC and FINRA investigations, Rule 8210 actions and CFP issues. His extensive background in securities litigation, investment fraud and general commercial litigation enables him to efficiently help clients when they are facing changes, challenges, investigations, lawsuits and other unpredictable events, including guiding and counseling advisors and brokers going independent through all stages of the process to avoid and lessen the risk of litigation where possible.

Andrew is active in the Financial Planning Association of Minnesota and has extensive experience in defending clients against FINRA Enforcement Actions, FINRA investigations and other securities-related regulatory matters, including basic RIA transactions.

Invest in Your Retirement Expertise.

1 hr CFP®, CRC®, and other CE Credit Reporting

We are a CE Sponsor with the CFP Board of Standards and the professional development partner of the International Foundation for Retirement Education (InFRE).

We will report your CFP® and/or CRC® credit (no additional reporting fee). Please add your ID at checkout. You are responsible for reporting all other certification CE credit.

Over 50 courses are accepted for continuing education (CE) credit for those who have earned the Certified Financial Planner® (CFP®) certification, the International Foundation for Retirement Education’s (InFRE) Certified Retirement Counselor® (CRC®) certification, the College for Financial Planning’s Chartered Retirement Plan Consultant (CRPC) certification, the American College’s designations (ChFC, CLU, RICP), Retirement Management Analyst designation (RMA), ASPPA and other certification or designations.

Do you need more than four hours of CE?

Then become a Subscriber! Just notify us that you want to become a subscriber within 10 days of course purchase to apply the cost of your individual cost to a new subscription.

Not familiar with on-demand courses?

We help you be sure you’re comfortable navigating our on-demand system. Just contact customer service by email anytime or by phone at 847.686.0440 x105 during eastern time regular business hours.

Your satisfaction is guaranteed. We know you will be pleased with your purchase of any of our courses or subscription products. If, however, you are not completely satisfied, just notify us within 30 days of your purchase to receive a full refund of your fee.